Comparing e-commerce providers Paypal + Stripe

|

|

|

|---|---|---|

| PayPal | Stripe | |

| Based in | US | US/San Francisco |

| Founded | 1998 | 2009 |

| Fees | 2.9% + 0.30 USD (US based sales), 4.4% + currency fee + 2.5% conversion (international sales), Lower fees for high volumes, charities, ‘micropayments’ | 1.4% + €0.25 for European cards, 2.9% + €0.25 for non-European cards, Chargeback Protection +0.4%, €0.03 per 3D Secure attempt |

| Has marketplace |

No |

No |

| Has affiliate network | No | No |

| Has SDK | No | API |

| Fund withdraw | Credit/debit card, Bank transfer | |

| Description |

PayPal is the most known online payment processors and online 'wallet' where you can store funds in multiple currencies. PayPal is owned by eBay. PayPal offers 3 Account Types which all allow you to send and receive payments.

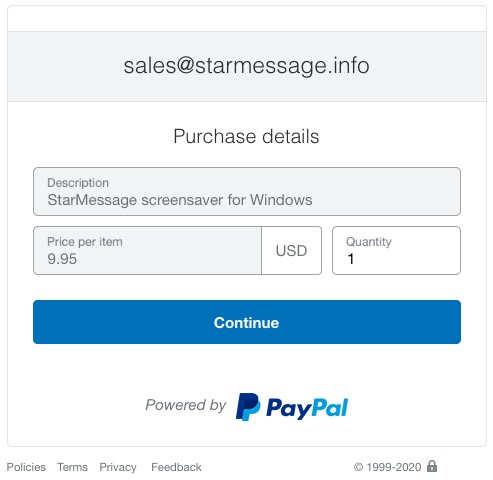

Seller name: In PayPal's buy page the customer sees the name of the seller and the name of the product or service they are buying.  showing the seller name and the product or service sold.

Issued debit card: PayPal Cash Plus account is required to get the Mastercard debit card. With the debit card you can use your account's balance like a normal bank account and make purchases from where ever the MasterCard is accepted. For example, you can use your account's funds to pay for your google adwords advertising. Google Adwords does not accept PayPal as a payment method and the debit card removes this barrier. Additional fees: In addition to PayPal's per-transaction fee, you will also incur the following fees:

|

Online payment processing for internet businesses. Stripe is a suite of payment APIs that powers commerce for online businesses of all sizes, including fraud prevention, and subscription management. Use Stripe’s payment platform to accept and process payments online for easy-to-use commerce solutions. |

| Advantages |

|

|

| Disadvantages |

|

|